Difference between revisions of "Supply Chain RFID Applications"

(→Project Report on RFID-Based Supply Chain Applications) |

(→Project Report on RFID-Based Supply Chain Applications) |

||

| Line 436: | Line 436: | ||

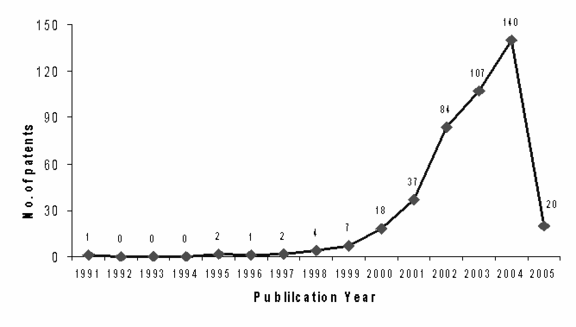

According to the search data IP activity in RFID base supply chain applications seems to have started during the year 1991. The graph shows terrific growth from 2000 onwards and high activity during 2004 with 140 patents records alone. Around 423 patents have been published in the span of 4.2 years from 2000 till date (Feb. 2005) indicating the potential in the field. | According to the search data IP activity in RFID base supply chain applications seems to have started during the year 1991. The graph shows terrific growth from 2000 onwards and high activity during 2004 with 140 patents records alone. Around 423 patents have been published in the span of 4.2 years from 2000 till date (Feb. 2005) indicating the potential in the field. | ||

| − | [[Image:IP_over_year.png|576px]] | + | [[Image:IP_over_year.png|576px|center IP landscape over years: Growth in RFID base supply chain applications]] |

Revision as of 04:15, 12 September 2006

Contents

Executive Summary

IP activity in the area of RFID-based supply chain applications seems to have started in 1991, and peaked in 2004. Most of the action in the integration of electronic identification system (RFID) with software system in supply chain applications has taken place in the last ten years or so.

Around 423 patents have been published in the span of 4.2 years from 2000 till February 2005. The major market in RFID-based supply chain applications appears to be the United States.

Technology area focus of key players:

- Digital Data Processing

- Communication Techniques

- Computing, calculating, counting

- Recognition of data; Presentation of data

- Signaling Or Calling Systems

Some of the key players identified are:

- United Parcel Service

- G.E.

- Silverbrook

- Micron Technology

- NCR Corporation

- SAP AG

- Savi tech.

Various software applications cited in patents:

- Business applications

- UPS Supply Chain Solutions

- Anti-collision software

- Program for correlating the environmental condition data with the location data.

- Software applications (Web application" TagDetect")

- Software applications supporting a client-server system or n-tiered computer system.

- MW (Micro-warehouse) enterprise application

- XML middleware such as Biz Talk software

- ERP system, web ordering system

- BeefLink Software

- Source code, object code, or scripting code.

Key applications area identified:

- Food and pharma industry

- Semiconductors and High-value electronic items

- Asset and materials management system

- Commercial enterprise

- Beef industry

- Airport and shipyard

Key RFID Tracking applications:

- Assets

- Equipment

- Materials

- Orders

- Personnel

- Processes

- Products

- Production

- Quality

- Resources

Mind Map

RFID Warehouse Application

RFID Application - SAP

Project Report on RFID-Based Supply Chain Applications

Content

Executive summary

Introduction to RFID technology in supply chain

Search approach and project scope

Objective

Data interpretation

Search strategy

Patent analytics:

Quantitative Analysis based on selected 30 patent records:

- IP landscape over years

- IP landscape by region

- Competitor landscape

- Technology trend

Qualitative Analysis based on 15 analyzed patent records:

- Classification of patents based on main claims

- SAO analysis clustering

- Problem Vs Solutions

- Main applications of RFID

- Main applications of RFID along with various stages, S/W applications and H/W involved

- Features cited in analyzed 15 patent records

- SWOT analysis

- Conclusion

Executive summary

IP activity in the area of RFID-base supply chain applications seems to have started in 1991, peaking in 2004. Most of the action has taken place in the last ten years. or even considerably lesser time in integration of electronic identification system (RFID) with software system in supply chain applications.

Around 423 patents have been published in the span of 4.2 years from 2000 till date (Feb. 2005) indicating the potential in the field.

Industries currently converging on developing RFID applications and services

Major market in RFID-base supply chain applications among key players appears to be United States.

Technology area focus by key players:

- Digital Data Processing

- Communication Technique

- Computing, calculating, counting

- Recognition of data; Presentation of data; Record carriers

- Signaling Or Calling Systems

key players have focused on building sound tools for: Administration, commerce, management, supervision and forecasting aspects for RFID-base supply chain Applications.

Key players identified are:

- United Parcel Service

- Alexeter Tech.

- Exago Pty Ltd

- G E

- SILVERBROOK

- IFCO System

- Micron Tech.

- NCR Corporation

- SAP AG

- Savi tech.

- Semb Corp.

- Telabout

Various software applications cited:

- Business applications

- UPS Supply Chain Solutions

- Anti-collision software

- Program for correlating the environmental condition data with the location data.

- Software applications (Web application" TagDetect")

- Software applications supporting a client-server system or n-tiered computer system.

- MW (Micro-warehouse) enterprise application

- XML middleware such as Biz Talk.RTM. software.

- ERP system, web ordering system

- BeefLink.TM. Software (is a collection of components written primarily in VISUAL BASIC® 6.0 programming language and

ACTIVE X® programming methodologies.)

- Source code, object code, or scripting code.

Key applications area identified:

- Food and pharma industry

- Semiconductors and High-value electronic items

- Asset and materials management system

- Commercial enterprise

- Beef industry

- Airport and shipyard

Key RFID Tracking Applications:

- Assets

- Equipment

- Materials

- Orders

- Personnel

- Processes

- Products

- Production

- Quality

- Resources

Introduction to RFID technology in supply chain

The supply chain is a complex multi-stage process which involves everything from the procurement of raw materials used to develop products, and their delivery to customers via warehouses and distribution centers. Supply chains exist in service, manufacturing and retail organizations.

Although, the complexity of the chain may vary greatly from industry to industry and firm to firm. Supply chain management can be seen as the supervision of information and finances of these materials, as they move through the different processes, by coordinating and integrating the flows within and among the different companies involved.

The efficiency of the supply chain has a direct impact on the profitability of a company. It is no surprise therefore to find that many large corporate companies have made it a key part of their strategy, and invested heavily in software systems (ERP, WMS...) and IT infrastructure designed to control inventory, track products and manage associated finance.

RFID will bring a new dimension to supply chain management by providing a more efficient way of being able to identify and track items at the various stages throughout the supply chain. It will allow product data to be captured automatically, and therefore be more quickly available for use by other processes such as ASN, stock management and real time billing.

Search approach and project scope:

The first task was to find the relevant U.S. granted patents, and EP granted patents or published patent applications. This was done for all patents published in years 1975 to 2005. This range of years is more than sufficient; but almost all of the action has taken place in the last ten years or even considerably lesser time in some categories.

I identified patents in RFID-base supply chain applications category using a patent search filter. Filter development and testing is

usually the most difficult and time-consuming part of a patent analysis, and that was certainly not the case in this research.

Patent search filters are sometimes relatively simple, but more often complex. Combinations of patent invention art classifications

and keywords in titles, abstracts and claims were targeted for search. Because I was working with a combination of US and EP documents, I used classifications based on the International Patent Classification (IPC) system.

Details on the approach of search is given in search strategy. Since the scope of project is limited to test, therefore only 30 patent records were selected for quantitative analysis and 15 for qualitative analysis.

Most of the indicators could not be project due to insufficient data.

Objective:

The aim of this project is to identify IP activity in the area of RFID-Based supply chain applications primarily focused on the application of software in warehouse, distribution, inventory control and also the related applications.

Data Interpretation:

Appropriate patent records were selected for analysis. The selection criteria was based on:

- Type of RFID tags (Active, Passive, Microwave or Chipless)

- Type of receiver (Mobile, Handheld, fixed)

- Tag system (Read-only/WORM (Write once read many times)/Read-Write tags)

- Type of reader (Interrogator)

- Type Sensor and RFID frequency

- Receiver link and software

- Applications by where the event takes place (Airport, shipyard, factory, warehouse etc.)

- Process involved (Shipping, receiving, inventory etc.)

- Type of software used (Middle ware, applications etc.)

Search strategy:

Date of search: xyz

Database used: USPTO, EPO and PatFam

Keywords used for searching are listed below:

| Device term | Action term | Application term | Other important terms |

| RFID | Data Track* | Supply chain | Software |

| Electronic identification | Data Captur* | Distribution | Program |

| Data Collect* | Warehouse | Computer | |

| Data Read* | Inventory |

The total number of patent records on RFID based supply chain applications sourced through search was 212, but only 30 records were selected for analysis. An additional broad search conducted (database: PatFem) to understand the actual IP activity (based on keywords and assignees) as depicted in below tables:

Search based on keywords and relevant hits:

| S. No | Key words | Search scope | No. of records available |

| 1 | RFID | 1975-2005 | 6147 |

| 2 | RFID AND WAREHOUSE | 1975-2005 | 444 |

| 3. | RFID and (SUPPLY CHAIN) | 1975-2005 | 212 |

| 4. | RFID and transportation | 1975-2005 | 573 |

| 5. | RFID and distribution | 1975-2005 | 1141 |

| 6. | RFID and SOFTWARE | 1975-2005 | 2301 |

Search based on assignees with relevant hits:

| S. No | Assignee | Search scope | No. of records available |

| 1 | 3M INNOVATIVE PROPERTIES COMPANY | 1975-2005 | 146 |

| 2 | SENSORMATIC ELECTRONICS CORPORATION | 1975-2005 | 66 |

| 3 | HEWLETT PACKARD DEVELOPMENT COMPANY | 1975-2005 | 63 |

| 4 | NOKIA | 1975-2005 | 58 |

| 5 | PHILIPS ELECTRONICS | 1975-2005 | 54 |

| 6 | SYMBOL TECHNOLOGIES INC | 1975-2005 | 49 |

| 7 | AVERY DENNISON CORPORATION | 1975-2005 | 24 |

| 8 | KIMBERLY CLARK | 1975-2005 | 19 |

| 9 | SILVERBROOK RESEARCH PTY LTD | 1975-2005 | 19 |

| 10 | UNITED PARCEL SERVICE OF AMERICA INC | 1975-2005 | 16 |

| 11 | IBM | 1975-2005 | 15 |

| 12 | SAP | 1975-2005 | 14 |

| 13 | SAMSYS TECHNOLOGIES | 1975-2005 | 11 |

| 14 | MEADWESTVACO CORPORATION | 1975-2005 | 8 |

| 15 | DE LA RUE INTERNATIONAL LIMITED | 1975-2005 | 8 |

| 16 | SAVI | 1975-2005 | 6 |

| 17 | MICROSOFT | 1975-2005 | 5 |

| 18 | WESTVACO CORPORATION | 1975-2005 | 5 |

| 19 | SENSITECH | 1975-2005 | 3 |

| 20 | UNITED SECURITY APPLIC ID INC | 1975-2005 | 3 |

| 21 | GAP INC | 1975-2005 | 2 |

| 22 | SEMBCORP | 1975-2005 | 1 |

| 23 | SHAW IP PTY LTD | 1975-2005 | 1 |

| 24 | EXAGO PTY LTD | 1975-2005 | 1 |

Patent analytics

IP landscape over years IP landscape over years: Growth in RFID base supply chain applications

(Actual scenario based on 423 patent records)

According to the search data IP activity in RFID base supply chain applications seems to have started during the year 1991. The graph shows terrific growth from 2000 onwards and high activity during 2004 with 140 patents records alone. Around 423 patents have been published in the span of 4.2 years from 2000 till date (Feb. 2005) indicating the potential in the field.

IP landscape by region

Competitor landscape

Technology trend