Innovative personal finance products

From DolceraWiki

Brief

- Identify innovative personal finance products in various countries

- Personal finance products such as loans, credit cards etc. customized and productized in ways to appeal to local markets

Approach

- Trend analysis

- Demographic trends

- Market trends

- Technology trends

- Regional trends

- Sociocultural trends

- Internet and communication trends

- Market analysis

- Quantifying above trends

- Estimating size of markets

- Identify needs based on trends

- Survey of existing products

- Analyze strengths, weaknesses of existing products

- Identify new products

- New product ideas

- Invent new products based on trends

- Qualify new product ideas

- Quantify market size for new ideas

- Identify implementation strategies for new ideas

India: Demographic trends

- Asia is exploding with money

- China, India etc. have a voracious appetite for credit

- People there are very worried about weddings, especially daughters' weddings can be extremely expensive

300 million strong middle class

- The Indian middle class is 300 million people with a purchasing power of US families with $15,000-$35,000 in annual income

- Huge appetite for two-wheelers, telephones and cars

Demographic dividend

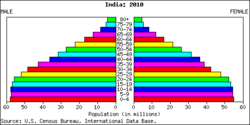

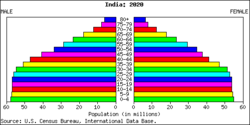

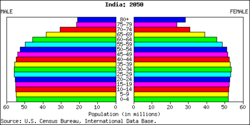

- With one of the youngest populations in the world, India is ready to reap the demographic dividend of a large, young workforce over the next several decades.

Education

- 50% of India's population is below the age of 25 and 2/3rd of the population is below the age of 35

Employment

- In some areas of knowledge services, salaries in India are coming close to American salaries in Purchase-Power Parity (PPP) terms

Personal income trends

- The top end of over 700,000 people out of India's population of over one billion is estimated to have individual liquid wealth of about $1,00,000 (Rs 44,13,000) which is likely to go up to $1.1 million by 2009. This represents a cumulative liquid wealth of $203 billion, estimated to go up to $322 billion by 2009. These are the findings of a recent study done by market research firm Synovate.

India: Financial trends

Overall economy

| GDP growth in FY 2005-06 | 8.1% |

|---|---|

| GDP growth predicted for FY 2006-07 | 7.5% |

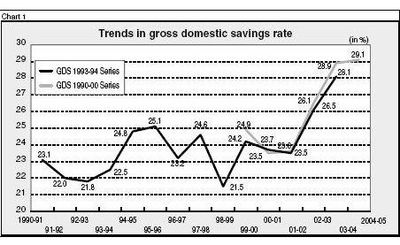

| Savings as percentage of GDP | 29.1% in FY 2004 and 25.9% in FY 2005 |

| Net income of Sensex 30 companies | 36.4% in FY 2005-06 |

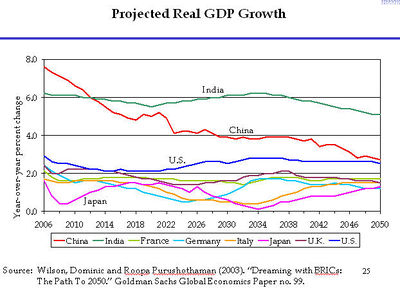

- GDP growth is projected at 6% and higher for the coming decades, making India the fastest-growing large economy in the world

Foreign Direct Investments

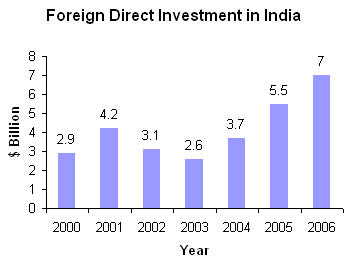

- Foreign Direct Investment inflows are rapidly growing in India and have reportedly reached an all-time high of $7 billion last year, doubling from just 6 years ago

India's high savings rate

- Savings rate are rising.

- With a strong GDP growth, rising salaries, and low social security, savings rate are likely to rise even further.

Credit

- Booming economy with a growing middle class

- Access to credit is relatively new

| "There is a great investment opportunity opening up in India. We term this investment area as the 'lifestyle segment.'" - Nilesh Shah, President, Kotak Mahindra Asset Management Co. Ltd. |

|---|

- Demand for consumer goods is growing rapidly

Rural credit

- Lack of access to savings mechanisms and credit is one of the biggest challenges for villagers in India.

- According to a World Bank study, in Andhra Pradesh, 59% of rural households lack access to deposit accounts and 79% don’t have borrowing facility from the organised financial sector. Bankers too complain that though the rural potential is huge, they don’t have enough knowledge about the rural customer.

- Innovative concepts, such as a mobile ATM machine are being tried out at the moment.

Microfinance

- 1.4 million microfinance groups in India

- Over 20 million members for microfinance groups

- According to one estimate, 30 million non-agricultural enterprises and 50 million landless households in India collectively need approximately $30 billion credit annually

- Microfinance is growing in South India, which contrasts with the stagnation in Eastern, Central and North Eastern India

- Downside: Microfinance involves very high transaction costs given the small amounts of money involved for each loan, which necessitates high transaction costs

Remittances

Hawala

- An illegal system of payment, hawala remains popular as a way of remitting money

Payments

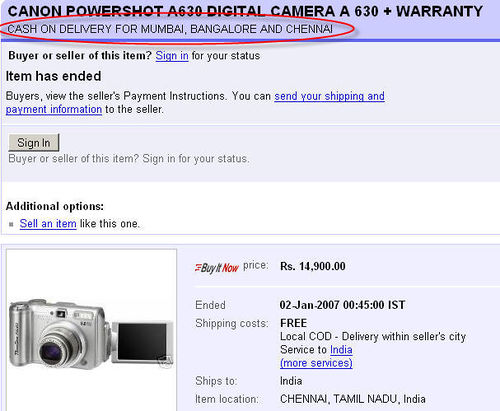

- Cash-on-delivery (COD) remains one of the preferred methods of payment

- Fraud is a major problem, e.g. loans on homes are based on higher valuations by the appraiser

- There is no credit rating system and the judicial system does not allow companies to easily recover their money from the borrowers

- A high amount of undisclosed income

- Hawala

- Cash-on-delivery (COD)

- Airlines, railways and others are now selling tickets online and it is cheaper than buying through an agent or from the airline. You need a credit card to buy these online.

- Pension funds are still big in India. Not clear if India will go the US route of defined contribution plan (as opposed to defined benefit plan)

India: Customer service

- If you want to open an account of if you want a loan, someone comes to your house from the bank to get the papers to you

- If you want to exchange currency, someone comes to your house for that too

India: Sociocultural trends

- Movies get financing from the underworld and other unsavory sources

Dowry

- The custom of dowry is well-entrenched in Indian society and puts extreme financial pressure on brides and their families

- An average of one dowry death is reported every 77 minutes according to the National Crime Record Bureau

India: Technology trends

- Internet access levels in India having gone up 132 per cent between 1997 and 2005

- Laptop ownership in India is at 10%

- Desktop ownership has increased 36% in India

Anecdotes

- There was this article about citibank or someone hiring goons to get an executive woman to pay her credit card bill. She defaulted because she was travelling. She created a big stinker.

- A grocery store in India figured out that its cost of capital was much higher than what their customers were earning in a savings account. They came up with a scheme whereby consumers could give them a deposit and they would give them coupons to shop in their store. The effective interest rate that the consumer was getting was higher than what a bank offered them, however the interest rate was however lower than the cost of capital for the grocery store and they got loyal customers.

Needs

- Non-traditional ways of evaluating credit worthiness

- How to give credit to developing markets using different approaches than developed markets

- Short-term loans

- High transaction fees but low interest

- Non-revolving credit card

- Need money to buy groceries this week, pay back next week or end of month (Payday loan?)

- Programs to help fund big events such as daughter's weddings

- Financial advisory services to high net worth individuals

- Financing for movies

- Simplified COD

- Escrow services

- Loans for individuals with lower credit scores (people who don't appear very credit worthy on paper)

- A clearing house that could collect cash from people's houses or stores for airline/railways transactions - that would be convenient for people without credit cards

Links

Idea 1 - helping India's middle class create assets while enjoying lifestyle

- Jewellers in India give lose guarantees that upon return of the jewellery, value of the metal in jewellery adjusted for workmanship costs will be redeemed. This acts as a big incentive for people to invest in jewellery as principal amount is secure. However, there is no formal guarantee mechanism to ensure the contract.

- This can be an opportunity for banks to step in, whereupon the banks can underwrite the value of the jewellery and assure full value upon jewellery redemption. Banks can extend loans to people to buy jewellery, whereby interest is charged differently for the value of the metal (lower interest rate) and higher for the loan against workmanship.

Idea 2

- Tailormade credit cards where a customer can choose from 3 preferred vendors, whose card he/she wishes to have.

Idea 3

- Sodexho like ration card passes delivered to corporates. Corporates in turn will pay the pass provider and in turn hand over such passes to their employees, who can only purchase ration with such passes.

Idea 4 - leverage indirect variables to determine creditworthiness

- India has a strong black economy

- Bank statements may not be the best indicators of a person's credit worthiness

- Indirect measures, like electricity consumption data or telephone bills data is a good indicator of a person's income

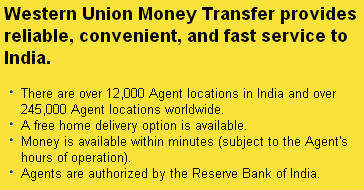

Idea 5 - Money transfer services for payments as low as 25USD

- India has a strong informal economy of workers, labourers etc.

- Such people belong to villages where population is as low as 5000

- Money transfer services for such people would be highly valuable

- Distribution network to such small villages is a challenge which can be overcome by tying up with FMCG majors like HLL that reach villages of 5000 population size

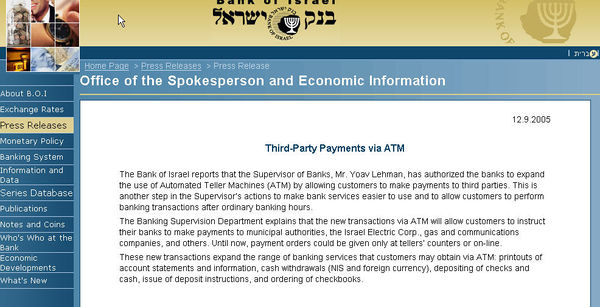

Idea 6 - Payment to 3rd party using ATM's

- ATM's can be used to pay to 3rd parties

- This will enhance the distribution network for P2P payments, bringing it to every nook and corner where there is an ATM