Veterinary Vaccines Market Report

Contents

- 1 Introduction

- 2 Market Overview

- 3 Major Players in the Veterinary Vaccines Market

- 4 Mergers and Acquisitions

- 5 Emerging Trends in Veterinary Vaccines

Introduction

Vaccination protects hundreds of millions of animals worldwide from disease and possibly death. Animals, just like humans, suffer from a range of infectious diseases. As veterinary medicine has advanced, prevention of disease has become a priority as healthy food comes from healthy animals. One of the best means of preventing disease is by creating immunity in the animal. This is usually achieved by vaccination.

Not all animals need every vaccine. Some, like clostridial disease prevention, are basically routine, just like childhood vaccination programmes. The vaccination programme chosen for farm animals depends on the management system, the location of the farm and the history of the herd or flock (and whether or not a disease is likely to be encountered). Most farm animals are young, and these animals (just like children) are often more susceptible to infection. So, for example, calves often need to be protected by vaccination against respiratory disease. Some of the diseases that can be prevented are shown below.

Species Diseases Controlled by Vaccines

- Cattle - Blackleg, tetanus, ’husk’ (lungworm disease), rotavirus, infectious bovine rhinotracheictis (IBR), respiratory syncytial virus, pasteurellosis, enteritis, leptospirosis, mastitis, ringworm, BVD, PI3, coronavirus, salmonella, E Coli.

- Sheep & goats - Clostridial diseases (8 different species including tetanus), pasteurellosis, ovine abortion (chlamydiosis and toxoplasmosis), louping ill, contagious pustular dermatitis (orf), footrot

- Pigs - Erysipelas, parvovirus, colibacillosis, clostridial disease, atrophic rhinitis, enteritis, porcine pneumonia, PRRS

- Poultry - Avian coccidiosis, avian encephalomyelitis, avian infectious bronchitis, avian infectious bursal disease, avian reovirus, chicken anaemia virus, duck virus enteritis, egg drop syndrome 1976, erysipelas, infectious laryngotracheitis, Marek’s disease, Newcastle disease, pasteurellosis, post-natal colibacillosis, salmonellosis, swollen head syndrome, turkey haemorrhagic enteritis, turkey rhinotracheitis

- Fish - Enteric redmouth disease, furunculosis, vibriosis (vibrio anguillarum, vibrio salmonicida and Vibrio viscosus (now named moratella viscosus))

- Dogs - Distemper, infectious canine hepatitis, leptospirosis, parvovirus, kennel cough (Bordetella bronchiseptica and canine parainfluenza virus). Also rabies for dogs going abroad as part of the PETS scheme.

- Cats - Feline infectious enteritis (or panleucopenia), feline leukaemia, chlamydia, cat ’flu’ (feline herpes virus and feline calicivirus). Also rabies for cats going abroad as part of the PETS scheme.

- Horses - Equine herpes virus 1, influenza, tetanus, viral arteritis. Also rabies (not routinely used in the UK)

- Rabbits - Myxomatosis, viral haemorrhagic disease

- Pigeons - Paramyxovirus, pigeon pox

Sources: National Office of Animal Health 1,2

Market Overview

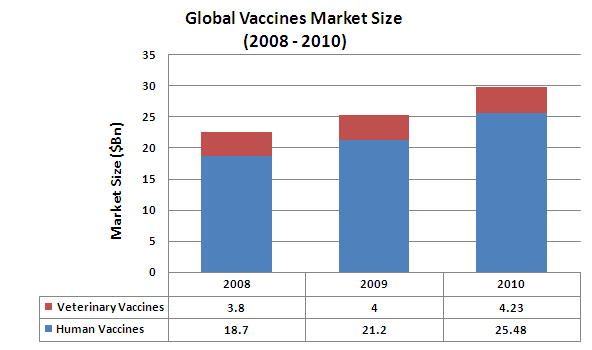

The global pharmaceutical industry was $825Bn in 2010, out of which the total Vaccines market accounted for only 3.6% ($29.71 Bn). The vaccines market is classified in two segments: Human Vaccines and Veterinary Vaccines market. The human vaccines market accounts for more than 80% of the total vaccines market, whereas the Veterinary vaccines market accounts for around 20% of the total vaccines market. The focus of this report will be on Veterinary vaccines.

Market Size of Vaccines

- The global sales of human and animal vaccines were $22.5 Bn in 2008. In 2010, it has reached approximately $29.71 Bn. The global vaccines market grew at a compound annual growth rate (CAGR) of 14.91% in 2008-2010.

- The global market for human vaccines in 2008 was $18.7 Bn and, with a continuing increase in the global market, reached $5.48 Bn in 2010.

- The Veterinary vaccines market grew from approximately $3.8 Bn in 2008 to about $4.23 Bn in 2010, an increase of about 5.51%.

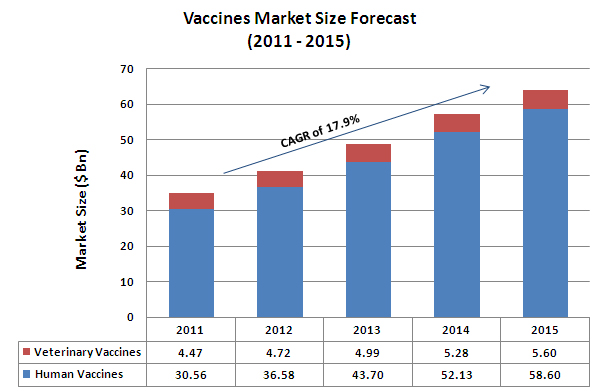

Market Forecast for Vaccines

- Veterinary Vaccines market is expected to increase at a 5.7% CAGR between 2010 and 2015 to reach $5.6 billion in 2015, driven by a growing number of diseases in animals, technological breakthroughs in biotechnology and growing awareness of animal disease

- Human Vaccines market is expected to grow at a CAGR) of 19.6% to reach $58.6 billion by the end of 2015.

Source: Dolcera Analysis

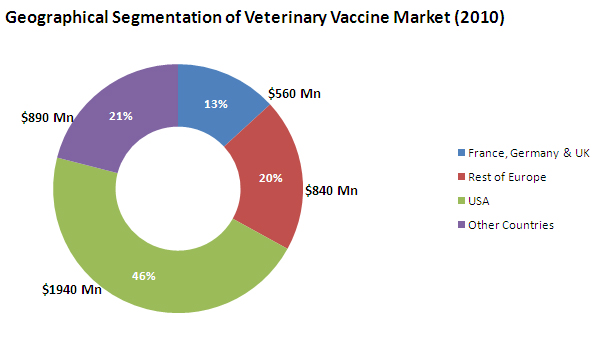

Geographical Segmentation of Veterinary Vaccines Market

- United States represents the largest market for Veterinary vaccines worldwide, with the market share of 46% and market size of $1.94 Bn in 2010. The growth in the US Veterinary market will slow down in future due to safety concerns, higher market maturity and fewer prospects for mass production and development of new products.

- Europe comes second, with the market share of 33% and the market size of $1.4 Bn in 2010. The European market is mainly driven by the growing demand for livestock. 40% of the revenues in Europe come from France, Germany and United Kingdom, which amounts to $560 Mn

Source: Dolcera Analysis

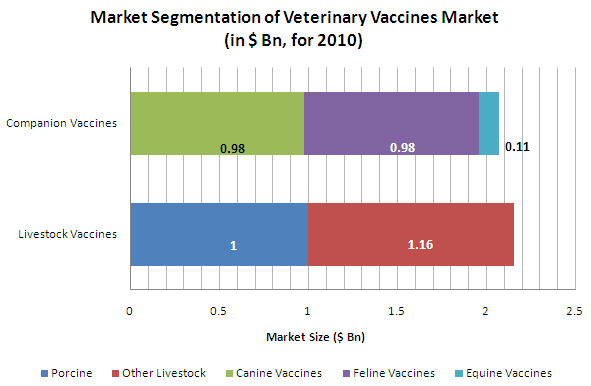

Market Segments of Veterinary Vaccines

Veterinary Vaccines market is divided into 2 major segments:

(i) Livestock Vaccines

(ii) Companion Vaccines

- Livestock mainly consists of Farm animals like Cattle, pigs, sheep, poultry, aquaculture and bees.

- Companion Animals mainly consist of Dogs, cats and horses.

- Livestock Vaccines Market:

- Among the two segments analyzed, Livestock Vaccines accounts for the larger share of about 59% in 2010.

- Porcine vaccines are the largest sub-segment within Livestock Vaccines.

- The revenues from Porcine Vaccines market have touched $1 Bn in 2010.

- Companion Vaccines Market:

- Companion Vaccines account for 41% of the Veterinary Vaccines market in 2010.

- Companion Vaccines market is sub-divided into 3 segments, namely, Canine, Feline and Equine.

- Among these segments, Canine and Feline segments are large and account for 95% of the sales in Companion Vaccines.

- Equine vaccines only accounts for 5% of the sales in this segment.

- Canine vaccines are the fastest growing segment within Companion vaccines with the growth potential of more than 5% over the period to 2015.

Source: Dolcera Analysis

Market Analysis of Veterinary Vaccines

The following chart shows the percentage breakup of all the 5 segments in the Veterinary Vaccines market. It also shows the market forecast for each of the segments for the years 2010 - 2015. Please click on the required segment in the pie-chart to get the market forecast for that segment in the bar chart.

Please click on the segments in the pie-chart to get the corresponding segment forecast for 2010-2015

- Porcine vaccines are the largest sub-segment in the Veterinary Vaccines market which is forecasted to grow to $1.32 Bn market by 2015.

- Canine and Feline Vaccine markets are slightly behind the Porcine Vaccines market in terms of market size

- Canine Vaccines is the fastest growing segment among all the sub-segments with the growth rate of 5.81%

Source: Dolcera Analysis

Major Players in the Veterinary Vaccines Market

This section lists the top players in the Animal Health Segment based on the revenue generated in 2010. It then analyzes the performance of these players in the veterinary vaccines market by looking at the breakup of the revenues generated by them in the vaccines market, current product portfolio in veterinary vaccines, their R&D focus areas in this segment, veterinary vaccines under clinical trial and the benefits from mergers and acquisitions in this market.

Key Players - on Revenue basis

Major Players in the Veterinary Vaccines market have been determined based on the revenues they made from Animal Health Segment in 2010. The following table lists down the top players in this market along with the revenues generated by them in Animal Health Segment in 2010. All the figures are in Billion $.

| Company | Revenues from Animal Health in 2010 ($ Bn) |

| Pfizer | 3.575 |

| Merck | 2.900 |

| Sanofi-Aventis | 2.635 |

| Bayer Healthcare | 0.800 |

| Virbac | 0.781 |

| Novartis | 0.500 |

| Boehringer Ingelheim | 0.354 |

| Heska Corporation | 0.065 |

Comparative Analysis of Key Players

The following interactive chart gives a snapshot of all the activities going on in the Veterinary Vaccines market. It gives the sales breakup for all the segments and sub-segments for all the major players in the Veterinary Vaccines market. It also lists down the area of clinical trials and future focus areas of all the major companies in this market.

Please click on the labels to get the corresponding information

- Pfizer is the market leader in the Veterinary vaccines market (by revenue) but Merck is the market leader in Livestock Vaccines market and Sanofi-Aventis is leading in the Companion Vaccines market.

- Livestock Vaccines market is more developed than Companion Vaccines market right now, but the later is catching up very quickly with more number of clinical trials in the Companion Vaccines area

- Two major areas of focus in the Veterinary vaccines market are:

- Parasiticides

- Infectious disease vaccines (Bacterian and Virus Vaccines)

Company Snapshot

The following interactive graph compares all the major players in the veterinary vaccines market on various parameters

- Pfizer Animal Health

- Merck Animal Health

- Sanofi-Aventis Animal Health

- Bayer Healthcare - Animal Health

- Virbac

- Novartis Animal Health

- Boehringer Ingelheim Animal Health

- Heska Corporation

Mergers and Acquisitions

The following section lists down the major mergers and acquisitions in the veterinary vaccines market and their implications on the veterinary vaccines business of the corresponding companies. It then goes down to analyse one acquisition made in this segment, in detail.

Major Mergers and Acquisitions

The following table lists down all the major mergers and acquisitions that took place in the last 2 years in the Veterinary Vaccines Market and the implications of the same, on the companies involved.

| S.No | Date of Acquisition | Acquiring Company | Acquired Company/Business | Country | Implications to Veterinary Vaccines business of the Acquiring company/ merged companies | % Stake Purchased | Consideration ($ Mn) | Source |

| 1 | 29-Dec-10 | Pfizer | Synbiotics Corp | USA | Synbiotics Corporation is a leader in the development, manufacture and marketing of immunodiagnostic tests for companion and food production animals. Pfizer Animal Health’s global reach, commercial operations, and expertise in regulatory and marketing functions will expand customer access to such leading products as WITNESS® and ASSURE® for companion animals, the SERELISA® franchise for livestock animals, and PROFLOK for poultry into new markets, especially in emerging markets for Synbiotics Corp. Marrying Synbiotics’ R&D expertise in diagnostics with the strength of Pfizer veterinary R&D also is expected to help accelerate our diagnostic development program. |

undisclosed | 735 | Pfizer Press Release |

| 2 | 14-Dec-10 | Novartis | Chiron Behring Vaccines | USA | Chiron Behring is a joint venture of Novartis Vaccines and Diagnostics Inc. and Aventis Pharma. Novartis and Aventis are currently fighting a couple of cases on the largest selling rabies vaccine brand, Rabipur, after the brand went to Novartis in 2009. Rabipur was the largest selling rabies vaccine brand in India sold by Aventis for the last one decade. With this transaction, this dispute will be mutually settled. Rabipur, the top selling rabies vaccine, with an almost 60% vaccine share was contributing atleast 10% to Aventis Pharma’s total revenue till it went to Novartis |

49 | 22.3 | Livemint |

| 3 | 11-Oct-10 | Pfizer | King Pharmaceuticals Inc | USA | The transaction will further expand Pfizer’s business profile, including animal health business that will offer a variety of feed additive products for a wide range of species because of the acquisition | 100 | 3600 | Bloomberg |

| 4 | 24-May-10 | Pfizer | Microtek International Inc | Canada | Microtek International, Inc. is a recognized innovator in aquaculture vaccines, R&D and healthcare diagnostic services. The acquisition further expands Pfizer’s commitment to a safe food supply from healthy beef and dairy cattle, swine, poultry and fish. Microtek not only brings to Pfizer Animal Health industry-leading vaccines and technology, but also complements Pfizer’s portfolio of health services and diagnostics for food animal production |

undisclosed | undisclosed | PRNewsWire |

| 5 | 5-Mar-10 | Virbac | Santa Elena laboratory | Uruguay | Virbac wanted to establish a strategic alliance in the area of vaccines designed for food producing animals. This laboratory specializes in biotechnological products of aerobic and anaerobic fermentation for the manufacturing of bacterian vaccines (inactivated and modified),and a wide range of stable cell lines for the production of virus vaccines, inactivated or lessened. With this alliance, Santa Elena will be able to use the solid commercial platform brought by Virbac and introduce its vaccines range in many markets abroad. Virbac on its side will benefit from Santa Elena’s skills and know-how in biology to help building up a development and manufacturing base for food-producing animals vaccines, allowing Virbac’s entry into this market segment. |

30 | 3.7 | Reuters |

| 6 | 12-Jan-10 | Virbac | Veterinary Assets from Pfizer Inc. | Australia | Virbac SA will acquire rights to a portfolio of livestock products historically marketed in Australia by Fort Dodge Animal Health for use in farm animals, primarily cattle and sheep. The portfolio includes parasiticides (80% of sales) and vaccines (20%) that achieved net sales of approximately AUD 36 million in 2009. This new portfolio will perfectly fit and complement the current range of products that Virbac Australia is bringing to its customers. |

100 | undisclosed | Reuters |

| 7 | 2-Nov-09 | Merck | Schering-Plough | USA | This will double the number of drugs in late stages of development for Merck | Merger (Merck shareholders would own 68% of the combined company) | 41,000 | Wall Street Journal |

| 8 | 14-Oct-09 | Pfizer | Wyeth | USA | Wyeth acquisition will diversify Pfizer’s pipeline, particularly in vaccines and in biologics Pfizer Animal Health will now offer an enhanced portfolio in beef, dairy, and companion animals, as well as a redefined product line for swine, equine and poultry |

100 | 68,000 | Reuters |

| 9 | 21-Sep-09 | Boehringer Ingelheim | Pfizer’s certain assets of Wyeth Pharmaceutical’s Fort Dodge Animal Health business | Several Countries | The deal significantly increases the size of Boehringer Ingelheim’s companion animal and cattle portfolios. Boehringer Ingelheim will acquire the Duramune® line of vaccines for dogs, the Fel-O-Vax® line of vaccines for cats, and the Rabvac® line of rabies vaccines manufactured and sold in the U.S., Canada and Australia. In addition, a portfolio of pet and equine pharmaceutical products currently sold in the U.S. is also included in the deal. The company will also acquire cattle vaccines in the U.S. and Canada including the Triangle®, Pyramid, and Presponse® vaccine lines. Pharmaceutical products being acquired include Cydectin® (moxidectin) for cattle and sheep as well as Polyflex® (ampicillin sodium). The dairy portfolio includes the key brands Today® and Tomorrow®. Several Canadian swine vaccines are included in the acquisition as are some cattle vaccines sold in Europe and South Africa. It will build more capabilities in the core vaccine segment and expand Boehringer Ingelheim’s already strong product lines |

100 | undisclosed | Americancattlemen |

| 10 | 17-Sep-09 | Sanofi-Aventis | Merial Ltd (50% stake from Merck) | USA | Merial makes pet medicines like flea-and-tick blocker, Frontline and chewable heartworm preventer Heartgard, plus Ivomec, a parasite killer in cattle. | 100 | 4,000 | Merck Press Release |

| 11 | 7-Jun-09 | Pfizer | RFCL-Vetnex Animal Health Unit | India | Vetnex is a market leader in poultry, livestock and pet healthcare and is one of the top three players in the Indian animal healthcare market. Opportunity to enter India market |

100 | 75 | Economic Times |

Analysis of Pfizer's Acquisition of Wyeth

| Date of Acquisition | 14-Oct-09 |

| Acquiring Company | Pfizer |

| Acquired Company | Wyeth |

| Country | USA |

| Consideration | $68 Bn |

Post the acquisition, Pfizer Animal Health is now the world’s leader in the discovery, development, manufacture and sales of veterinary vaccines and medicines for livestock and companion animals.

Relevance to Pfizer Animal Health Business

Fort Dodge Animal Health is one of the divisions of Wyeth, which is a leader in the manufacturing of prescription and over-the-counter vaccines and pharmaceuticals for veterinary medicine as well as livestock.

Reasons for the acquisition

1. Diversified its U.S. portfolio

The following products have been added to Pfizer Animal Health portfolio post acquisition:

- Beef and dairy animal health portfolio - FACTREL®, SYNOVEX®

- Swine market portfolio - SUVAXYN®, SUVAXYN PCV-2

- Poultry Health Portfolio - POULVAC®, MATERNAVAC® IBD-Reo

- Equine health portfolio - WEST NILE INNOVATOR ®, FLU VAC INNOVATOR ®, QUEST®, QUEST PLUS®

- Canine portfolio - LYMEVAX®

2. Foray into new business areas

- Wyeth has expanded Pfizer's presence in animal health

- Augments in-line and pipeline portfolio in “invest to win” disease areas

- Enhances the scientific, manufacturing and pharmaceutical science capabilities of Pfizer

- Provides the best opportunities for world class, high performing talent in the industry

3. Strengthens Platforms for Improved, Consistent and Stable Earnings Growth

- Pfizer’s CAGR before acquisition (2008-13)= -5.3%

- Wyeth’s CAGR before acquisition (2008-13)= 4.3%

- Combined Pfizer-Wyeth CAGR (2008-13) = 0.9%

- Wyeth contributes a large revenue increment to Pfizer

4. Addresses Revenue Loss from Lipitor patent expiry

- Lipitor accounted for over 28% of Pfizer's sales in 2008

- Lipitor was going to lose US patent exclusivity in 2011, leading to significant revenue losses

- This acquisition makes up for the revenue loss from the exclusivity of Lipitor

Legal Issues due to the acquisition

The complaint charges that the proposed transaction likely would harm competition in each of the relevant markets by reducing the number of suppliers and leaving veterinarians and other animal health product customers with limited options. Without the competition provided by Pfizer and Wyeth in these markets, customers are more likely to see prices rise, according to the complaint. The complaint further alleges that the entry of new competitors in these markets would not be timely, likely, nor sufficient to offset the loss of competition, and that the transaction would increase the likelihood that Pfizer could act on its own or with other companies to raise prices.

Divesture of certain Animal Health Assets of Wyeth to Boehringer Ingelheim

Pfizer divested some of the Fort Dodge Animal Health products it acquired from Wyeth, within 10 days from the acquisition, to Boehringer Ingelheim to settle the anticompetitive effects the Federal Trade Commission believes are likely to result from the transaction in numerous markets for animal health products.

Due to this transaction, the Federal Trade Commission approved that it would not harm consumers in any prescription drug market where the companies currently overlap, reduce incentives to innovate, create intellectual property barriers, or allow Pfizer to engage in anticompetitive marketing.

(Source: Federal Trade Commission)

Emerging Trends in Veterinary Vaccines

- Companion Veterinary Vaccines are trailing on high growth track

- Livestock Vaccines market is more developed than Companion Vaccines market right now, but the later is catching up very quickly with more number of clinical trials in the Companion Vaccines area

- In companion vaccines, canine vaccines is forecasted to grow at the highest pace and is expected to be the leading segment in the Veterinary Vaccines market

- Two major segments in focus:

- Canine

- Porcine

- Two major areas of focus in the Veterinary vaccines market are:

- Parasiticides

- Infectious disease vaccines (Bacteria and Virus Vaccines)